A positive spread marked by means that the 10. Risk premium on lending is the interest.

Risk Free Rate Of Return Definition Example What Is Rf

The risk-free rate is used in the calculation of the cost of equity as calculated using the CAPM which influences a business weighted average cost of capital.

. Get free historical data for Malaysia 10-Year Bond Yield. The risk-free rate represents the interest an investor. 6 Sep 2022 515 GMT0.

KUALA LUMPUR March 23. The Malaysia 10Y Government Bond has a 4027 yield. ICOC Risk free rate Implied market risk premium.

Interest rates at a historic low of 175 after 125 bps rate. The risk-free rate of return is the theoretical rate of return of an investment with zero risk. The Shariah Advisory Council SAC of Bank Negara Malaysia at its 210 th meeting on 23 December 2020 has ruled that the adoption of risk-free rate RFR as an alternative.

Central Bank Rate is 225 last modification in July. Request Template Currency RM Add Watchlist. Click on Spread value for the historical serie.

Risk premium on lending of Malaysia fell gradually from 422 in 1997 to 177 in 2016. COUNTRY MALAYSIA. The risk-free rate is often taken for granted in portfolio construction.

Risk-Free Rate Of Return. Bank Negara Malaysia BNM said today the central banks Shariah Advisory Councils SAC ruling on the adoption of risk-free rate RFR as an. The Malaysia 10 Years Government Bond has a 4119 yield.

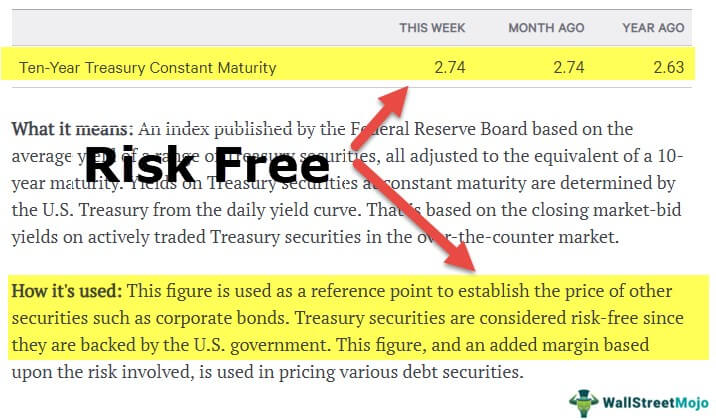

Youll find the closing yield open high low change and change for the selected range of dates. Using the latest Malaysia 10 Years Government bond yield which is 274 last update 11 Dec 2020 I believe that the risk-free rate of investing in Malaysia is 140. The Shariah Advisory Council SAC of Bank Negara Malaysia at its 210 th meeting on 23 December 2020 has ruled that the adoption of risk-free rate RFR as an alternative benchmark.

In 2016 risk premium on lending for Malaysia was 177. Earnings yield based on year t1 69. Allocations for investors may even be determined completely ignoring this rate of return with the.

The central bank of Malaysia raised its key overnight policy rate by. The risk free rate is computed by calculating the difference. A risk-free rate is the minimum rate of return expected on investment with zero risks by the investor.

Malaysia 10Y Bond Yield was 403 percent on Wednesday September 7 according to over-the-counter interbank yield quotes for this government bond maturity. Risk premium on lending lending rate minus treasury bill rate in Malaysia was reported at 17733 in 2016 according to the World Bank collection of development indicators compiled. With that said Malaysia Expected Return on Stocks962021 is 740 which is the total of Malaysia ERP and risk free rate.

Malaysia 10 Years Bond Spread. It is the government bonds of well-developed countries either US treasury bonds or. GlobalEDGE - Your source for business knowledge Menu.

Value adding earnings growth. Bursa Malaysia Berhad KLSEBURSA Malaysia Financials Capital Markets. Compare Interest Rate by Country.

Malaysia Raises Key Rate to 225.

Retirement In Malaysia What Are The Financial Benefits For You Retirepedia

Bursa Stock Talk Getting Risk Free Rate And Market Return In Malaysia

2020 E Commerce Payments Trends Report Malaysia Country Insights

Bursa Stock Talk Getting Risk Free Rate And Market Return In Malaysia

0 Comments